By Kerri Quinn

Head of Index Solutions

Record Volatility Creates Rare Opportunity

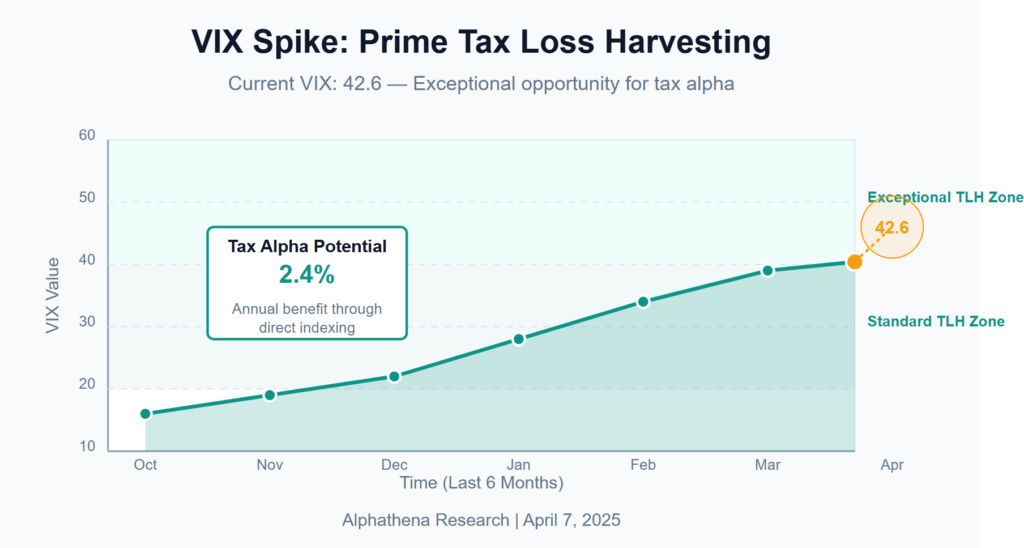

The VIX reached 42.6 last week amid ongoing trade tensions and tariff implementations. This reading places current market conditions in rarified territory, joining just a handful of extreme volatility events over the past two decades.

Historic Volatility Creates Opportunity

VIX Historical Peaks (2008–2025)

As shown above, the current volatility spike ranks alongside major market disruptions like the 2008 Global Financial Crisis (79.1), 2020 COVID-19 Pandemic (82.7), and the 2010 Flash Crash (45.8). Historically, these periods of extreme volatility have created unique environments for disciplined investment strategies.

Studies from Wealthfront and Parametric, clearly illustrates the correlation between market volatility and enhanced tax-loss harvesting opportunities. By employing direct indexing, which facilitates granular, security-level tax management, investors can capture significantly increased tax alpha during volatile market conditions.

The data underscores a compelling pattern that’s been validated by multiple independent sources—including Wealthfront, Parametric, O’Shaughnessy, BlackRock, and Kitces:

- Low volatility (VIX < 15) typically yields limited tax alpha, averaging around 0.3% annually

– Consistent with Kitces & Betterment’s findings (2015), which reported 0.2%–0.9% in low-vol environments - Moderate volatility (VIX 15–20) elevates potential tax alpha to approximately 0.8% annually

– Aligns with Wealthfront’s 2019 white paper, which reported 0.9%–1.8% tax alpha in normal conditions - High volatility (VIX 20–30) increases achievable tax alpha to about 1.2% annually

– Supported by BlackRock’s broader tax alpha range of 0.4%–2.0% depending on market volatility - Very high volatility (VIX 30–40) pushes potential tax alpha benefits upward to approximately 1.8% annually

– Matching Kitces and Parametric’s observations during elevated volatility periods - Exceptional volatility (VIX > 40)—as seen during COVID market conditions—has historically provided investors with up to 2.4% annual tax alpha.

– As confirmed by Wealthfront’s 2020 TLH analysis (2.2%) and Parametric’s Q1 2020 report (1.9%–2.6%)

This correlation is not coincidental. Elevated volatility increases stock and sector dispersion, which creates more frequent and deeper unrealized losses across portfolios. These pockets of loss can be harvested strategically—capturing tax value—while maintaining market exposure and avoiding portfolio drift. Whether you’re managing a book of high-net-worth clients or building enterprise-scale platforms, the message is clear: volatility amplifies tax-loss harvesting opportunities, and having the right tools in place makes all the difference.

Related Readings

- Understanding Tax Alpha: Calculation Methods and Impact

- Tax Alpha: Maximizing After-Tax Returns Through Strategic Portfolio Management

- Maximizing Returns Through Tax Alpha: Strategies for Any Market

- Navigating Tariff Turbulence with Direct Indexing and Tax Loss Harvesting

- Implementation Options and Advanced Approaches in Direct Indexing

- https://research.wealthfront.com/whitepapers/tax-loss-harvesting

- https://osam.com/Commentary/a-case-study-in-tax-loss-harvesting

- https://www.kitces.com/blog/automated-tax-loss-harvesting-technology-software-value-risks-gaps-benefits/