The investment world continues to evolve, and long/short direct indexing stands out these days.

This approach combines traditional direct indexing benefits with advanced strategies previously reserved for institutions creating unique opportunities for today’s market participants. A traditional tax loss harvesting strategy focuses on diversified, long-only equity portfolios creating value by realizing capital losses to offset gains. However, these strategies tend to ossify over time meaning, as portfolios appreciate, the ability to harvest new losses diminishes.

Recent research has shown that adding margin (borrowing) and short selling provide a portfolio with more opportunities to harvest losses. A recent study published in the Journal of Asset Management by Goldberg, Cai, and Schneider (2024) sheds new light on how investors can use leverage and shorting to dramatically extend the life and effectiveness of tax-loss harvesting strategies. Their findings are particularly relevant for high-net-worth investors with substantial capital gains to offset, as leveraged and short positions provide additional avenues for capturing tax losses in various market environments.

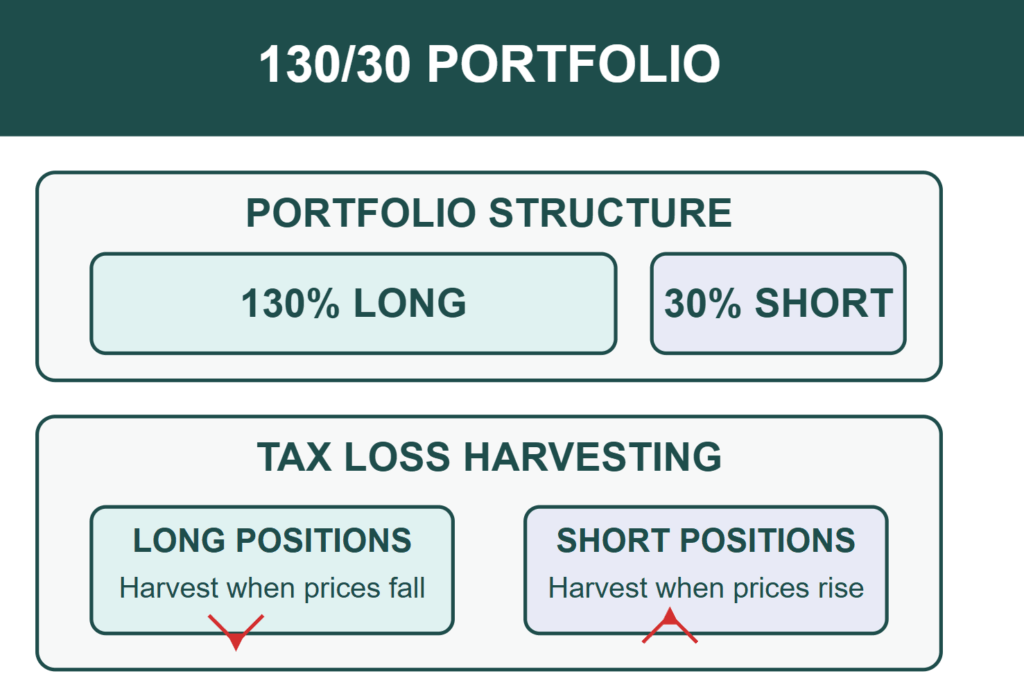

So, what is a 130/30 Long Short Direct Index Portfolio?

A 130/30 long short portfolio is 130% long exposure investing in stocks you expect to outperform and 30% short exposure borrowing and selling stocks you expect to underperform. This structure amplifies that ability to harvest losses from both sides of the portfolio. When long positions decline in value, portfolio managers can realize losses on the long side. When short positions rise in value resulting in a short-side loss, managers can also realize those losses. By tapping into both long and short opportunities, a 130/30 portfolio creates a more consistent loss harvesting potential, even in rising markets.

While long short direct indexing introduces new layers of complexity, the potential to amplify tax loss harvesting and extended portfolio efficiency makes it a strategy worth considering. Not every investor will need it but those who can leverage it will provide stronger after tax outcomes.

At Alphathena, our platform is built to help advisors and portfolio managers seamlessly incorporate cutting edge strategies. We’re redefining what’s possible in personalized, tax-efficient investing.

Further Readings:

A Guide to 130/30 Loss Harvesting – Goldberg, L.R., Cai, T. & Schneider, B. (2024). Journal of Asset Management.

Tax Loss Harvesting and Long-Short Strategies – Larry Swedroe (September 2024)

The Time Value of Capital Losses – Lincoln Fleming & Taotao Cai (October 2024)

Tax-Rate Arbitrage: Realization of Long-Term Gains to Enable Short-Term Loss Harvesting – Goldberg, Cai & Hand (2021)

Direct Indexed Tax Loss Harvesting: Are the Benefits Worth the Fees? – Advisor Perspectives (September 2024)