When clients stay with an advisor, it’s rarely because of portfolio performance. Instead, it comes down to connection and trust. Clients can tell when their values, goals, and financial complexity are understood and reflected in the way their money is managed.

And yet, many advisors still lean on off-the-shelf models and prepackaged portfolios that look nearly identical to what clients could get anywhere else.

This is where personalized indexing can make an impact. You may have only thought about personalized indexing as a portfolio strategy, but it can also play a role in your relationship strategy.

Unlike mutual funds or ETFs, personalized indexing allows advisors to build and manage a portfolio of individual securities tailored to each client’s specific tax situation, values, and risk profile. In essence, clients can own a version of the market designed just for them.

Direct indexing should help you prove your value in ways that clients can feel and see. That’s what keeps them around.

Clients Stay Where They Feel Seen

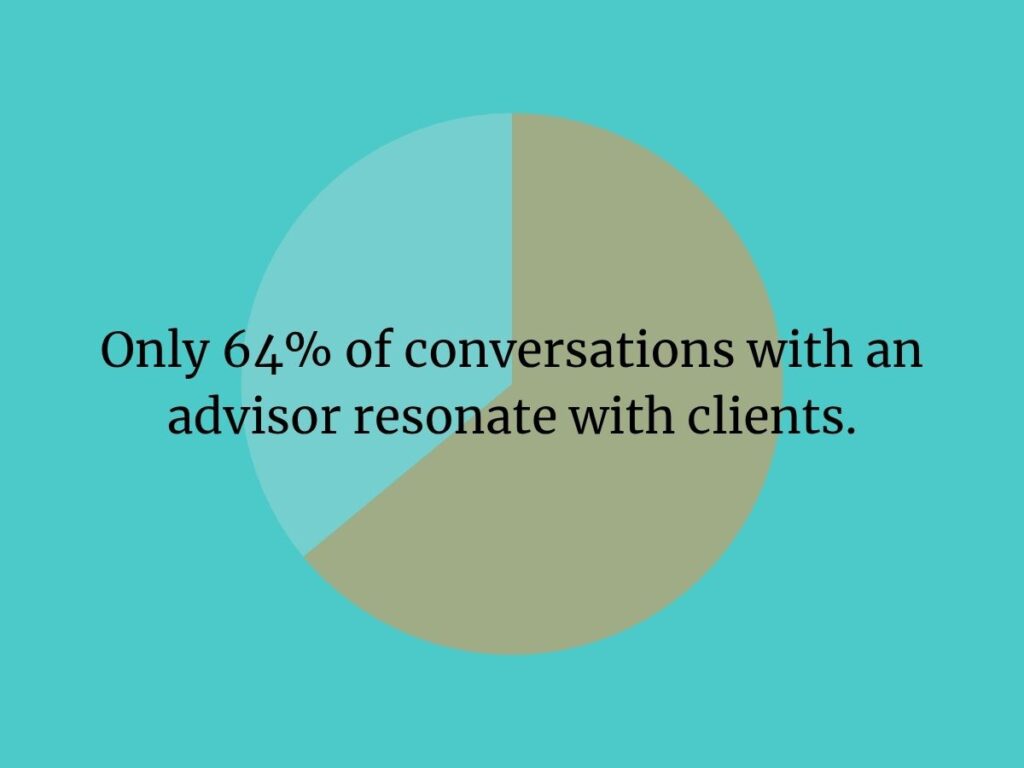

According to a 204 YCharts study, most clients don’t feel particularly seen or heard by their financial advisor. Only 64% of conversations resonate with clients. That’s down 6% from the year prior.

That’s not a portfolio management problem. That’s a client experience problem.

Personalized indexing gives advisors a way to build loyalty through alignment. With Alphathena, you can reflect a client’s values, tax circumstances, investment objectives, and risk parameters within a custom-built index.

It’s a living, breathing portfolio that proves you’re paying attention.

That’s a message that wins new business and helps you keep clients engaged over the long haul.

Why SMAs Miss the Mark

To meet rising expectations, some advisors have turned to separately managed accounts to offer direct indexing. But in doing so, they typically hand off control to third parties. When an advisor outsources one of their core values, the end result is less transparency into the investment process, less personalization for each client, and reduced client loyalty when they don’t see their values reflected in how their advisor manages their money.

Alphathena was built to flip that model.

Our platform keeps you in the driver’s seat.

You control the portfolios, manage the rules, and stay close to the client. We automate where it counts with tax-loss harvesting, multi-account rebalancing, and thematic tilts. But we add that AI-powered automation without replacing your role or removing your flexibility.

The Tools That Prove Your Value

The truth is that as more technology-fueled investing solutions enter the consumer marketplace, personalization is one of the few ways left where advisors can truly differentiate themselves. The need for personalization isn’t new, of course; the ability to scale personalization across a large client base, however, is a recent advancement.

Helping advisors prove their value through differentiated investment solutions is why we built Alphathena.

Our platform helps you:

- Customize portfolios to reflect each client’s values, goals, and preferences

- Harvest tax losses year-round, automatically, and intelligently

- Handle complexity across multi-account households

- Offer long/short strategies and thematic tilts with a few clicks

- Diversify concentrated positions over time, with tax-aware portfolio transitions built in

And we built it for firms who want to start fast and not disrupt their existing workflows. You don’t need to change custodians or retrain your team. You can start showing your value right away.

Cerulli: Customization is the Future

As Cerulli Associates has noted, advisory firms are aware of the need to offer more customization, but few firms are taking the shift in consumer expectation seriously.

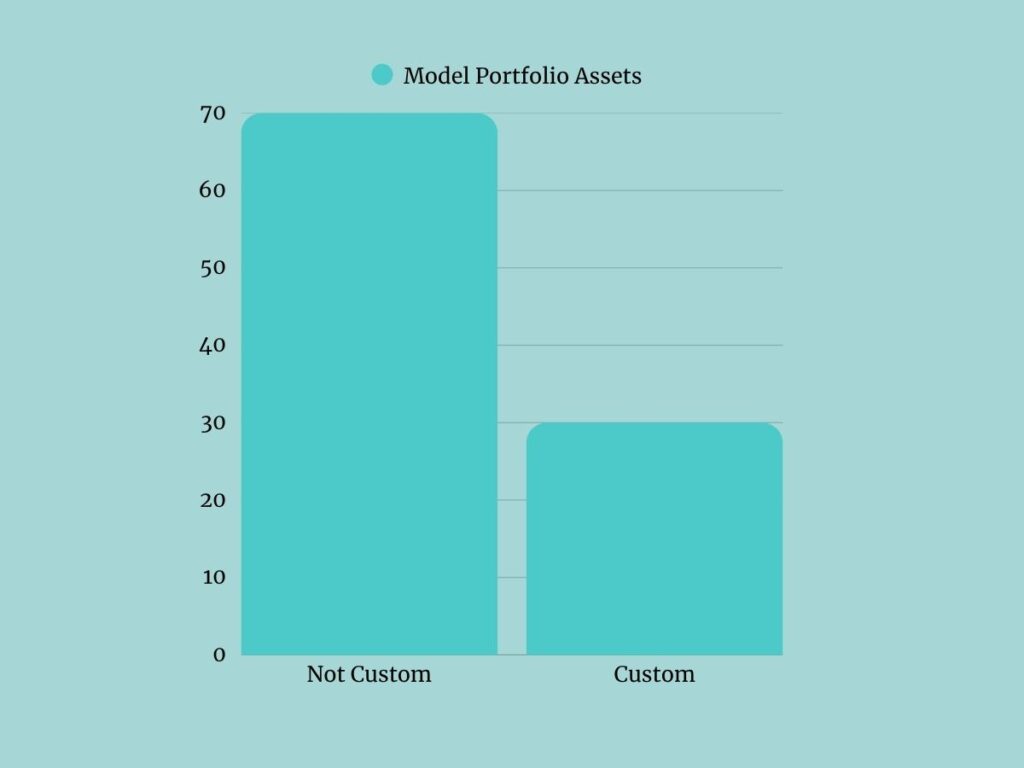

A 2024 survey found that 70% of total model portfolio assets are still allocated to off-the-shelf model assets. How long will it be until generational shifts, fee compression, and technology advancements lead to clients (especially younger clients) who are fed up with the status quo?

In this type of environment, personalized indexing becomes your edge.

It moves conversations from abstract benchmarks to real-life alignment, makes your advice tangible, and positions you as a modern advisor that high-value clients want.

When everything in your client experience is built to create trust—down to the investment strategies that you create and manage on behalf of clients—clients are less likely to shop around for a new advisor.

Ready to Go Deeper?

If you’re already leveraging Alphathena to provide personalized indexing, now is the time to expand. Our support team can show you to how to implement tax-loss harvesting, scale adoption across your firm, and customize portfolios by goal, sector, or ESG preferences with our AI assistant.

Not using Alphathena yet?

Start by downloading our “Direct Indexing 101” guide. It’s a quick overview that will help you reframe the way you deliver investing value.