What is direct indexing?

It’s a question advisors (and consumers) ask often.

The technical definition is a fairly easy one. But the technical definition you might find in Investopedia no longer tells the full story.

A better question to ask today is “What should direct indexing be in 2025?”

Yes, direct indexing still means constructing a portfolio by owning the individual securities of an index rather than buying an ETF or mutual fund that packages them all up for you.

But that answer, while correct, is incomplete. It misses the evolution we’re seeing across the industry. It doesn’t reflect what clients are asking for or what advisors are capable of delivering.

So let’s explore that reframed question. Not what is direct indexing—but what should it be?

A Movement from Tracking to Transformation

For decades, direct indexing was primarily a tool for tax optimization, and more than that, it was an option reserved exclusively for high-net-worth investors who wanted to harvest losses without straying from benchmark exposure.

Tax optimization is still a huge part of the appeal of direct indexing. But in 2025, the possibilities have expanded.

Direct indexing should no longer be viewed solely as an investment strategy. It should be understood as an operating system that turns an advisor’s expertise into a scalable, personalized investment experience.

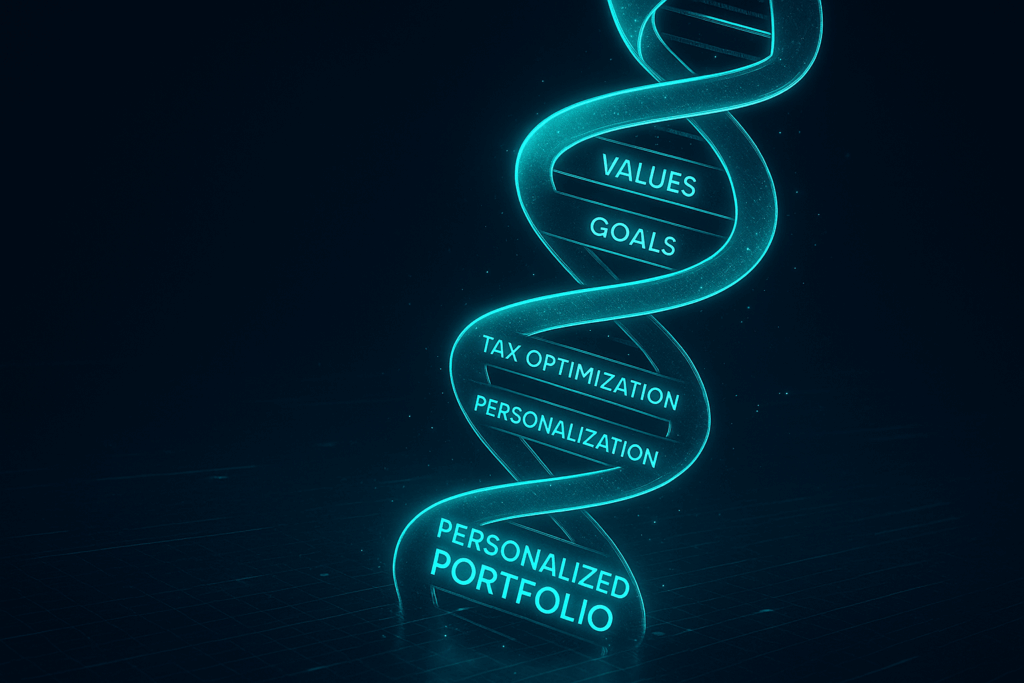

Direct indexing needs to go further than simple index replication—that’s table stakes these days. Advisors should be able to shape portfolios that reflect each client’s values, goals, and tax sensitivities, and they should be able to do it without relying on institutional-level staff or back-office complexity.

And, perhaps even more importantly, they should be able to offer this type of flexibility to any client they serve. The mass affluent included, not just the wealthy.

This shift from precise replication to personal transformation is what separates modern direct indexing solutions from their legacy counterparts.

A Platform for Personal Differentiation

I feel confident in saying that every advisor who’s spent any length of time in the industry has likely felt the frustration of trying to prove their value in a world where nearly every investment offering looks the same.

Consumers today all can access the same ETFs, the same model portfolios, and the same talking points whether they invest with Vanguard, Schwab retail, Robinhood, or Betterment.

When done right, direct indexing breaks that cycle.

It gives you the flexibility to build portfolios that align with what your clients actually care about. Whether it’s a values-based exclusion, a concentrated position they want to keep (as many highly-paid FAANG employees do), or a specific performance objective, you’re able to accommodate those nuances without compromising your broader investment thesis.

But here’s the key: personalization only works if it’s also practical.

That’s why we’ve focused so much of our energy on making Alphathena not just powerful, but easy to use. We leverage AI to help you build and maintain portfolios at scale. Our platform automates tax-loss harvesting, tracks rules-based rebalancing, and enables proposal generation and transition analysis to help close more business faster. And we do it in a way that keeps you in control instead of asking you to outsource your best qualities.

At the end of the day, you want your client to trust in you. Not an algorithm or a decision being made by a black box solution..

No Platform Uprooting Required

One of the great myths about direct indexing is that it requires advisors to upend their operations just to get started. But there are legacy systems that still approach direct indexing solutions like it’s 2015. They ask you to migrate assets to their platform, change your custodian, endure weeks or months of onboarding…it can be a mess, honestly.

This is not how modern software works. It’s not how Alphathena is designed to work, either.

We’ve built our platform to meet you where you are. Whether you want to launch with a single household or roll out a firmwide offering to dozens or even hundreds of advisors, our system integrates directly into your existing custodian and tech stack.

You don’t have to worry about a data conversion or changing your current workflows. Instead, we adapt our platform’s powerful capabilities to accommodate your existing workflows, and most of our clients are able to get up-and-running in a week.

This level of flexibility matters, because it gives you the freedom to experiment and evolve. That’s something you should demand from every Fintech you work with. You can start small, move quickly, and build something better.

Your Client Is Still the North Star

At Alphathena, we serve advisors. But our mission ultimately centers on providing a system that enables better outcomes for investors. Your clients!

When your clients see their investments reflecting their values, their goals, and their tax profile, something powerful happens. They become more engaged, more trusting of your advice, and more likely to stick with you through the ups-and-downs of the market and life.

As organic growth rates seemingly stall across the industry, this type of connection is the silent engine that can fuel advisory firms. Nothing creates relevance and trust faster than personalization that actually delivers results.

So, What Should Direct Indexing Be in 2025?

We believe direct indexing shouldn’t be treated as an outsourced service. Rather, it should sit alongside financial planning and CRM as one of the foundational pillars in the modern advisor tech stack.

Alphathena is direct indexing for builders. It’s an investing platform for advisors who want to craft outcomes for clients, not just step out and pass off relationships once a client onboards. It’s for firms that see investing as a key part of their value prop and not a checkbox outsourced to a black box solution.

Legacy platforms turned direct indexing into something slow, obscure, and out of reach. We’re putting it back into the hands of the people it was built for: advisors.

Embrace your autonomy, not dependency. Stay in control and win.