I’ve been to a fair number of wealth management conferences this year, and there is one topic that’s been dominating the conversations: AI.

Every booth, every panel, every demo seems to promise “AI-powered” transformation. It’s exciting, but it’s also overwhelming. Because behind all the noise, advisors are quietly wondering the same thing:

What’s real, and what’s just marketing?

As someone who spends a lot of time talking with advisors, I can tell you one thing: the appetite for AI is high, but the trust gap is also high.

Advisors want to understand how AI can actually make their work better without replacing the human judgment that defines good advice.

If you’re evaluating new technology or planning how AI fits into your 2026 tech stack, here are four questions that can help you separate the signal from the noise.

AI for Financial Advisors: 4 Questions Every Advisor Should Ask

1. Does AI learn and adapt from you, or just automate predetermined steps?

Many platforms are quick to claim they’ve added AI when what they really mean is automation technology. If a tool simply follows a fixed set of rules, that’s not intelligence. It’s a workflow that runs on its own.

True AI for financial advisors should learn from your patterns and adapt to your preferences over time. For example, does it understand the way you rebalance portfolios? Can it surface insights that align with your investment philosophy?

An AI-enhanced system gets smarter with each interaction, reflecting how you already think and work. Automation can help you save time, but adaptation compounds your expertise.

When you evaluate a new system, ask to see a demo that shows ways the AI acts in a proactive way, instead of just completing a series of preprogrammed actions that you have to create.

2. What large language models (LLMs) does it use and how secure is your data?

Not all LLMs are created equal. Some are open models that prioritize accessibility, scale, and using data to train the entire model. Others are private and designed with stronger data safeguards.

When you connect client data to an AI system, you’re responsible for understanding where that data goes, how it’s stored, and whether it’s ever used to train external models.

Good vendors will be transparent about this. Great vendors will show you how they go above and beyond to protect your firm’s intellectual property and client information while still delivering meaningful insights.

Advisors have to be able to safely leverage AI without compromising client confidentiality or regulatory standards. Before signing a contract, make sure your provider can say the same.

I’m no compliance consultant, but it’s a good idea to always check with your compliance officer to get their opinion, and have the way your client data is used by AI as part of your written policies.

3. Will it help you make smarter decisions or just remove busywork?

The fastest growing category of AI that we’ve seen so far with advisors is designed to handle low-level tasks: meeting summaries, call transcriptions, or email drafts. Those tools are helpful, but they’re only a small part of the AI picture.

The most valuable AI for financial advisors should add true intelligence to your workflow. The critical question isn’t so much about whether AI can draft an email in five minutes; it’s whether or not your AI tools are helping you think better.

For instance, can your AI surface portfolio drift risks before they become client concerns and support portfolio management? Can it synthesize macro data, historical data, and client goals (including risk tolerance) to suggest personalized adjustments? And only then after it’s done the insightful work, can it translate those data points into an on-brand email for you to review and send?

Busywork reduction is great. But the next generation of wealthtech needs to go further. It needs to equip advisors to make faster, more confident decisions rooted in their client’s best interests.

4. Is it built to integrate across your tech stack, or will it live in isolation?

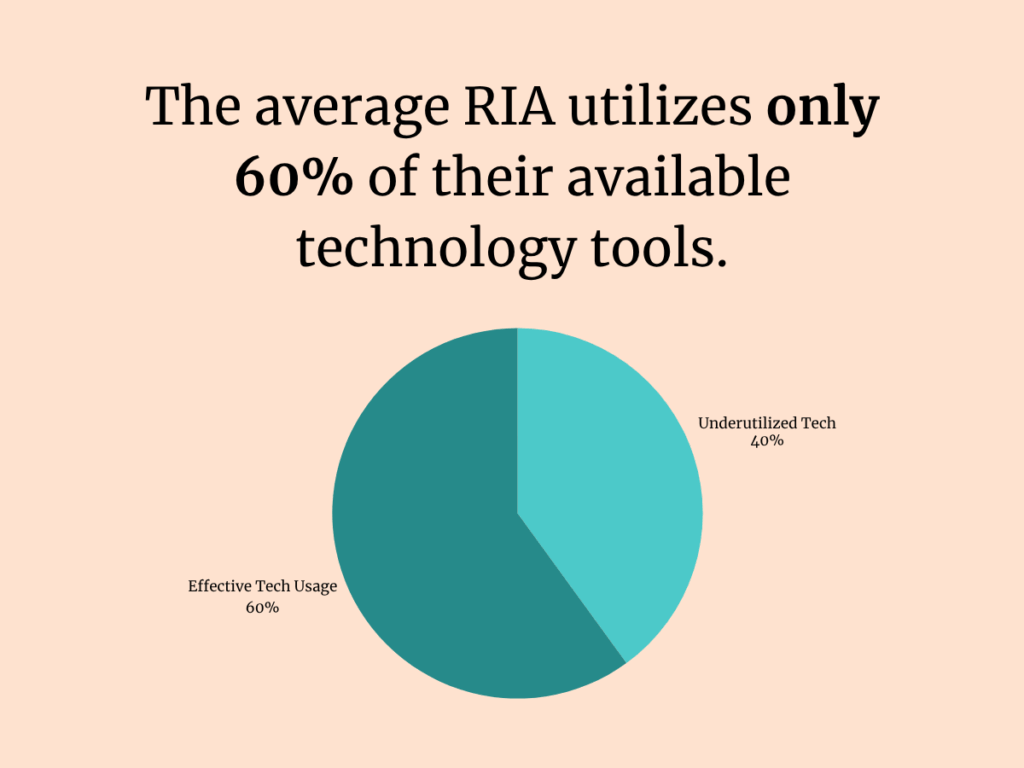

The average RIA uses a wide variety of software tools daily, but only utilizes about 60% of their available tools. Adding one more system that doesn’t talk to the rest only risks creating more platform fatigue than you’re already experiencing.

Before you commit to new AI solutions, look into how they fit with your existing ecosystem. Ask whether they integrate with your CRM, trading tools, reporting software, custodians, and meeting platforms.

An AI agent that operates in isolation, or doesn’t have full access to your entire data set, can only offer partial insights.

An integrated one can connect the dots to analyze portfolio data, client preferences, and communications. Then, it can offer the possibility of generating comprehensive, firmwide recommendations that benefit firms of all sizes.

The AI Solutions Transforming Advisor Technology

For the modern RIA, AI tools have quickly moved from proof-of-concept to a core component of the tech stack. This shift isn’t about replacing human judgment, though, it’s about amplifying it.

The new generation of AI solutions helps advisors stay focused on delivering advice that’s personal and human. For most advisors, that all began with AI notetaking assistants, but it won’t stop there.

AI Notetaking Assistants for Client Meetings

The rise of AI assistants has quickly shifted the way financial advisors approach client meetings. By integrating AI tools into their daily workflow, advisors have reconfigured every stage of the client meeting process, from preparation to follow-up, to remove manual tasks.

AI assistants help financial advisors prepare for meetings by surfacing relevant client data, recent portfolio changes, and key financial goals, ensuring that every conversation is focused and productive.

During client meetings, AI tools can take on the heavy lifting of capturing important details, allowing advisors to stay present and engaged with their clients. This means less time spent on administrative tasks and more time building trust, understanding client needs, and providing personalized financial advice.

Furthermore, by capturing every detail, AI notetakers help financial advisors maintain compliance, document important discussions, and ensure that nothing falls through the cracks.

After the meeting, AI assistants like Jump and Zocks can generate summaries, highlight action items, and even draft follow-up communications, making it easier for advisors to stay organized and responsive.

Beyond simply recording notes, advanced AI notetakers can identify action items, assign follow-up tasks to team members, and flag areas that require further attention. This enables advisors to stay organized, delegate effectively, and provide timely responses to client needs.

The result is a more efficient, client-centric approach that strengthens relationships and sets advisors apart in a competitive financial services industry.

The Future of Artificial Intelligence is AI Agents

Today, it’s easy to think of AI as synonymous with chatbots that answer client questions or notetakers that record and summarize meetings.

But the real frontier of AI in wealth management goes much deeper, building on the foundation of AI-powered tools that have already begun to transform the industry.

The future is AI Agents. Essentially, you can think of these as digital teammates that analyze, communicate, and act within your platform in a proactive manner, delivering significant benefits to businesses in the financial advisory space.

An AI Agent is a program that can anticipate needs, prioritize tasks, and prepare actionable insights using advanced machine learning models.

For example, imagine receiving a prompt that highlights clients who are most likely to benefit from a tax-loss harvesting opportunity this week, and their accounts are ranked by impact and ready for your review.

In this scenario, a lead advisor or team member can quickly act on the AI agent’s insights to deliver timely, personalized advice. This type of scenario does automate your work (it finds the accounts for you) but it also augments your ability to provide timely advice (by finding the opportunities and putting them in front of you).

This is the direction the industry is heading, where AI can be a partner in your workflow.

The Human Advantage in an AI World

Advisors often ask whether AI will replace parts of their role. Prognosticators are asking if AI can replace an advisor entirely.

My answer is that AI can manage data, but it can’t manage relationships or provide the human connection that is essential to building trust and understanding with clients. It can summarize trends, but it can’t sense anxiety in a client’s voice or the pride behind their child’s latest milestone.

When used intentionally, AI becomes an accelerant for human expertise. It frees your time, helps with staying focused, and helps you scale personalization.

In other words, all the things your clients are demanding more of in 2025 and beyond.

At Alphathena, we believe financial professionals are the most powerful force in wealth management. AI for financial advisors should be about amplifying an advisor’s expertise, not automating it away.

That’s why we describe our approach as AI-enhanced, not AI-powered. The distinction matters.

AI-enhanced technology keeps you in control, ensuring essential human oversight, so you can scale your unique advice across every client relationship, but not pass off your value to your tech.