Without a doubt, direct indexing has transformed modern portfolio construction. With the control it gives when managing a portfolio, advisors gain the ability to fully tailor portfolios that reflect client values, optimize taxes, and provide differentiated experiences.

But direct indexing is not a strategy that says to “buy the S&P and call it a day.” There’s a feature quietly reshaping what direct indexing can do, and most advisors don’t even know it’s available.

The approach, known as long/short direct indexing, offers a differentiated way to design portfolios with greater flexibility.

For advisors looking to stand out in a sea of sameness, it might be the kind of upgrade that changes the way a firm offers and talks about its investment management solutions.

What Is Long/Short Direct Indexing?

At its core, long/short direct indexing is about adding depth and dimension to a custom index. It lets you, as an advisor, take long positions in securities you believe will outperform and short positions in those you believe will underperform.

The result? A more precise way to reflect client goals, views, and risk preferences.

In our explainer post, we outlined how this strategy works while still being able to hedge against outsized risk.

The takeaway is simple: this isn’t about complexity for complexity’s sake. It’s about giving advisors more tools to serve clients well, even when there isn’t a bull market to cooperate.

Why Advisors Should Consider Long/Short Direct Indexing

There are three forces putting pressure on advisors today:

- Market uncertainty makes it harder to rely on traditional asset allocations.

- Client expectations have shifted toward hyper-personalized financial solutions.

- Fee compression forces firms to prove value or risk getting undercut by a more technologically-advanced firm that can operate with better margins.

Direct indexing already helps solve some of these challenges, but long/short capabilities go a step further by enabling tactical flexibility and thematic expression. That’s something ETFs and models typically don’t do well.

A personalized strategy like long/short can also operate as a client retention lever. Overall, investors say that are not particularly loyal to their advisors when surveyed. In fact, one survey found that only 55% of Millennials are “very satisfied” with their advisor.

Offering a more personalized, responsive investing experience could become a reason why a client would choose to stay with their current advisor over looking for another.

Personalization with Teeth

Direct indexing is often described as a way to reflect values or manage taxes, and that’s a true description, but it’s also not comprehensive.

What if direct indexing could also reflect conviction?

With long/short direct indexing, you (and your clients) can express opinions about sectors, factors, or themes in both directions. One simple example: You can tilt positively toward clean energy or quality stocks while shorting fossil fuels or low-volatility laggards.

While traditional indexing is centered on tracking a benchmark, long/short indexing generates a much more custom strategy that aligns with client priorities and investment convictions.

Why Long/Short is an Enhanced Over Traditional Direct Indexing

Most direct indexing platforms are still stuck in a long-only framework. They let advisors personalize with positive screens, but leave no room for hedging or active positioning.

In practice, that means portfolios end up feeling like passive clones with slightly different tilts. When every advisor offers the same thing, clients start asking harder questions about fees and results, and the ability to express your value proposition becomes more limited.

Our long/short framework breaks through that ceiling, bringing award-winning technology—recognized by Morningstar as a FinTech Best in Show and multiple Wealth Management Industry finalist nominations—to bear on one of the most underutilized opportunities in advisor-led investing. It gives you the ability to design, implement, and manage custom indexes that reflect more than preference; they reflect strategic convictions.

And all of it happens within the same system, with no extra accounts to open or manual intervention to slow down your day. All that’s left is smarter, advisor-led indexing.

Understanding 130/30 and Long/Short Portfolio Mechanics

That’s enough overview and theory for now. Let’s dive into a particular way you can use long/short direct indexing in your firm.

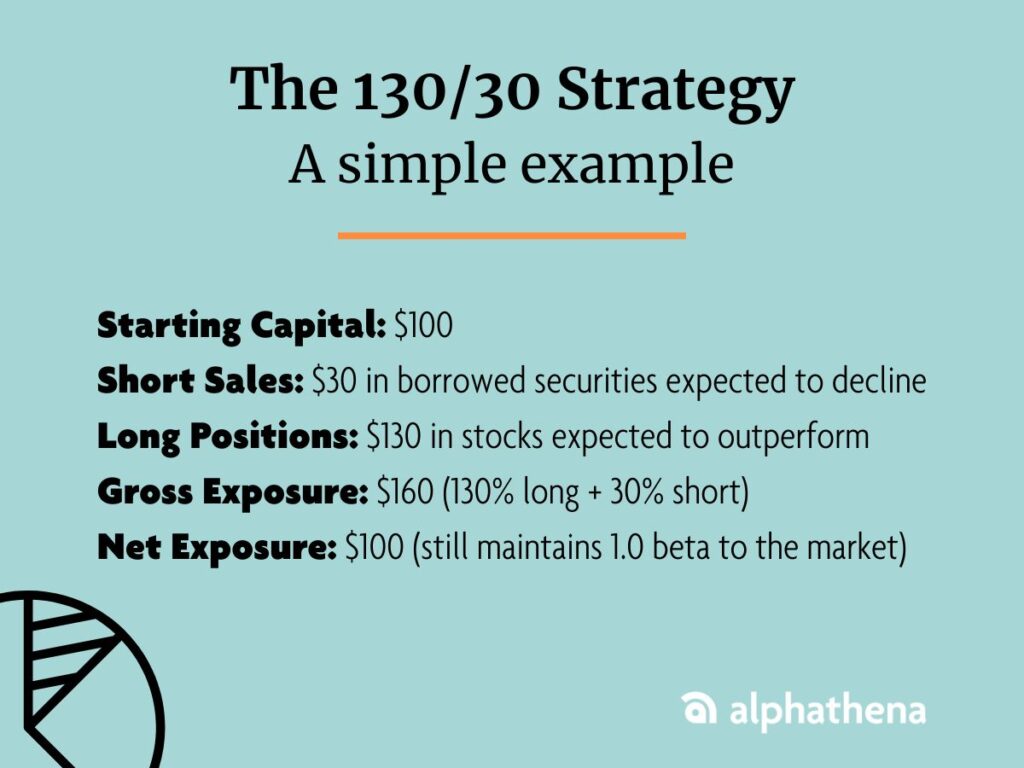

One of the most common long/short structures is the 130/30 strategy. Here’s how it works:

- Starting Capital: $100

- Short Sales: $30 in borrowed securities expected to decline

- Long Positions: $130 in stocks expected to outperform

- Gross Exposure: $160 (130% long + 30% short)

- Net Exposure: $100 (still maintains 1.0 beta to the market)

This structure gives you a simple way to add alpha-seeking overlays without changing the overall market risk. It enables tactical tilts, conviction-based positioning, and differentiated personalization with full visibility into every step of the entire process.

To understand how these levels can be applied within a direct indexing structure, read our strategy deep dive of 110/10 to 140/40 direct indexing strategies.

Why Long/Short Wins on Taxes in Any Market

Traditional tax-loss harvesting is dependent on markets going down. If the year is up, there’s not much for you to do but wait until the charts turn red again.

Long/short changes that and allows you to be active in any market scenario. Here’s why:

- In a bull market, long positions gain, but short positions likely lose, which creates harvestable losses

- In a bear market, short positions gain, but longs likely lose, again creating harvestable losses

This dual strategy setup generates a consistent stream of realized losses to offset gains elsewhere in a portfolio.

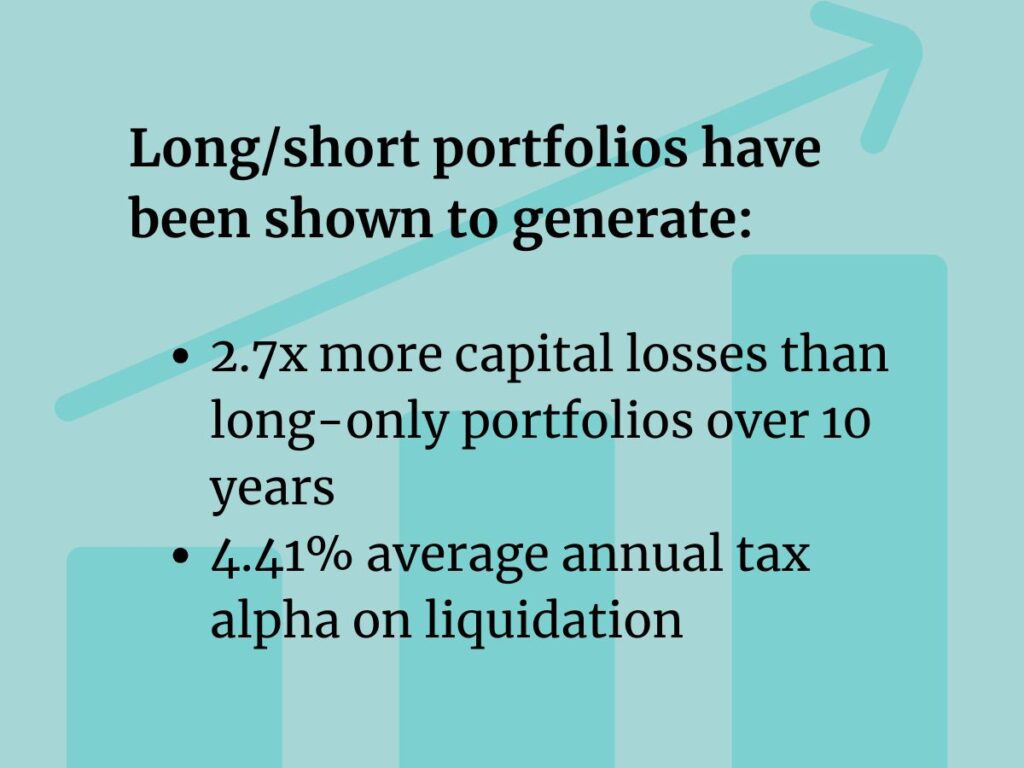

In fact, long/short portfolios have been shown to generate:

- 2.7x more capital losses than long-only portfolios over 10 years

- 4.41% average annual tax alpha on liquidation*

For clients with high income or large embedded gains, the tax efficiency boost from long/short direct indexing can be a game-changer.

How to Implement Long/Short Direct Indexing on Alphathena

If it all sounds a little complex, take a deep breath. You don’t need to manage the complexity themselves.

Alphathena simplifies it. Here’s what you need to choose:

- A margin account on either Schwab or Fidelity

- Choose your benchmark: S&P 500 or Russell 1000

- Set your long/short allocation (like 130/30 or 150/50)

From there, the Alphathena platform steps in to help you automate work like this:

- Portfolio construction

- Borrow cost optimization

- Loss harvesting and wash sale avoidance

- Risk controls such as position limits, dividend screens, or liquidity filters

Long story short (no pun intended): Long/short indexing with Alphathena offers the simplicity of direct indexing, combined with the strategic capability of a modern, advisor-controlled investment engine.

Gain Alpha Without Sacrificing Control

Traditionally, you might assume that more advanced strategies would require outsourcing to an SMA manager or another third party. You could take that approach, but doing so means giving up control, transparency, and often, the ability to customize client portfolios at all.

We don’t believe that’s the best way for an advisor to demonstrate their unique value. With Alphathena, you stay in charge. You build the model. We handle the execution across long and short exposures to help you apply tax optimization automation and honor client-specific constraints.

For you, that means more time spent meeting with and advising clients instead of managing complex spreadsheets.

Direct Indexing Just Got Smarter

Long/short direct indexing is not a niche upgrade. It’s a natural next step for advisors who want to deliver more without complicating their practice.

Alphathena makes it easy to deliver these capabilities within your existing practice.

Ready to see it in action? Schedule a demo and explore how Alphathena can help you implement these strategies with confidence.

*A guide to 130/30 loss harvesting. Journal of Financial Strategies, Volume 25, Pages 445–459, (2024). Published: October 17, 2024. Open access.